Key Takeaways from Berkshire Hathaway’s Latest Financial Results

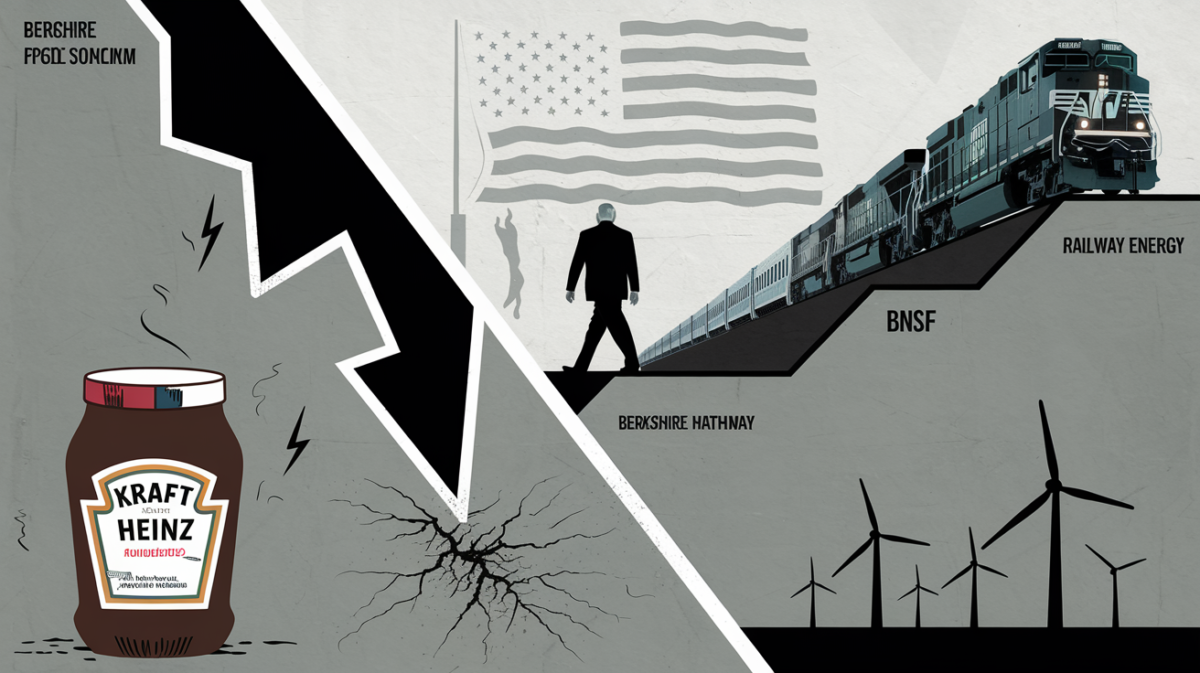

Berkshire Hathaway, the conglomerate led by legendary investor Warren Buffett, has reported a notable decline in its second-quarter earnings. The drop is largely attributed to a $3.76 billion after-tax writedown on its stake in Kraft Heinz, reflecting ongoing challenges since the 2015 merger of Kraft Foods and H.J. Heinz. The company’s net income fell sharply to $12.37 billion from $30.25 billion a year ago, while operating earnings—considered a more stable measure—slipped 4% to $11.16 billion.

Insurance and Consumer Goods Sectors Face Headwinds

Berkshire’s insurance division, a cornerstone of its business, saw operating income drop by 12%, with the reinsurance segment particularly affected. Meanwhile, the company’s consumer goods businesses, including brands like Fruit of the Loom and Brooks Sports, struggled under the weight of increased tariffs imposed by U.S. trade policies. This led to a 5.1% year-over-year revenue decline in the consumer products division.

Challenges in Key Divisions:

- Insurance: Operating income fell by 12%, with reinsurance underperforming.

- Consumer Goods: Revenue dropped 5.1% due to tariff impacts.

- Kraft Heinz: A $3.76 billion writedown reflects long-term struggles.

Bright Spots in Railroads and Energy

Despite these setbacks, some of Berkshire’s subsidiaries delivered strong performances. BNSF Railway, the company’s railroad business, posted a 19% rise in operating profit. Berkshire Hathaway Energy also reported gains, benefiting from cost controls and lower fuel expenses.

Top Performing Subsidiaries:

- BNSF Railway: Operating profit up 19%.

- Berkshire Hathaway Energy: Profits rose due to efficiency measures.

Stock Performance and Leadership Transition

As of August 1, 2025, Berkshire Hathaway’s Class A shares closed at $711,480, down 1.44% from the previous session. Class B shares, however, saw a slight uptick of 0.16%. The market’s reaction comes amid news that Warren Buffett, 94, will step down as CEO by year’s end, with Vice Chairman Greg Abel set to take the helm. Buffett will remain as chairman, but analysts have raised concerns about the company’s future performance without his day-to-day leadership.

Stock Market Snapshot:

| Metric | Value |

|---|---|

| Class A Share Price (BRK.A) | $711,480 (-1.44%) |

| Class B Share Price (BRK.B) | $472.84 (+0.16%) |

| Intraday Volume | 371 |

| Intraday High | $715,191.27 |

| Intraday Low | $707,500.00 |

Analyst Concerns and Future Outlook

Analysts have noted that Berkshire’s shares have underperformed the S&P 500 by 22 percentage points since Buffett’s retirement announcement. Key concerns include diminished investor confidence, a lack of new investments, and slowing growth in the insurance sector. However, the company’s substantial cash reserves—$147 billion as of the latest report—provide a cushion for future opportunities.

What to Watch:

- Leadership Transition: Greg Abel’s strategies as incoming CEO.

- Investment Activity: Will Berkshire deploy its cash reserves?

- Sector Performance: Can insurance and consumer goods rebound?

Conclusion

Berkshire Hathaway’s second-quarter results highlight both challenges and resilience. While the Kraft Heinz writedown and tariff impacts weigh on earnings, strong performances from BNSF Railway and Berkshire Hathaway Energy offer a silver lining. With a leadership transition underway and significant cash reserves, the company remains a focal point for investors navigating an uncertain economic landscape.