In a high-stakes clash over the future of weight-loss medications, telehealth giant Hims & Hers Health Inc. has refused to back down from pharmaceutical heavyweight Novo Nordisk. The dispute centers on compounded versions of popular drugs like Wegovy and Ozempic, which Hims & Hers has offered at a fraction of the brand-name prices. As regulatory changes reshape the market, both companies are scrambling to adapt—but only one seems willing to compromise.

The Heart of the Conflict

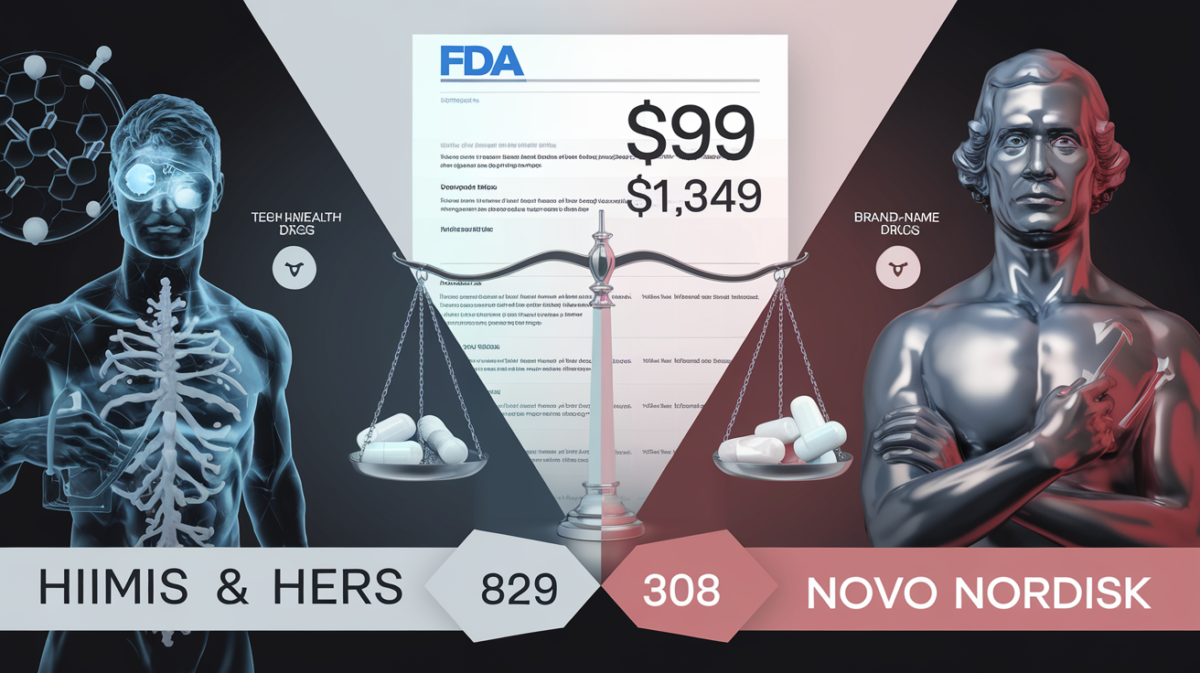

The controversy began when Hims & Hers started selling compounded semaglutide injections—the active ingredient in Wegovy and Ozempic—for just $99 per month. This was a stark contrast to the list prices of $1,349.02 for Wegovy and $935.77 for Ozempic. The move was initially possible due to an FDA emergency measure allowing pharmacies to compound these drugs during a shortage. However, when the FDA lifted the shortage status in May 2025, the loophole closed, and mass production of compounded versions was banned.

Novo Nordisk, the maker of Wegovy and Ozempic, quickly took action, terminating its collaboration with Hims & Hers and accusing the company of “illegal mass compounding and deceptive marketing.” The Danish pharmaceutical giant has been aggressive in protecting its market share, even as demand for affordable weight-loss solutions skyrockets.

Financial and Operational Fallout

The regulatory shift has hit Hims & Hers hard. The company announced a 4% reduction in its workforce—about 68 employees—as it phases out its compounded weight-loss offerings. Its stock plummeted nearly 26% following the FDA’s decision, reflecting investor concerns about the company’s ability to pivot.

Despite the setbacks, Hims & Hers CEO Andrew Dudum remains defiant. “We won’t cave to Novo’s demands,” he said in a recent statement. “Our mission is to make healthcare accessible, and we’ll find other ways to deliver on that promise.”

Novo Nordisk’s Countermove

While Hims & Hers grapples with the fallout, Novo Nordisk is doubling down on its strategy. The company has partnered with telehealth providers, including Hims & Hers, to offer branded Wegovy directly to consumers. This move aims to capture market share while ensuring patients have access to FDA-approved treatments.

Novo Nordisk’s approach highlights a broader trend in the pharmaceutical industry: as telehealth grows, drugmakers are increasingly collaborating with digital health platforms to reach patients directly.

Public Reaction and Market Impact

The dispute has sparked heated debates online. On platforms like Reddit and YouTube, users are divided:

- Affordability Advocates: Many argue that compounded drugs are the only affordable option for those without insurance coverage.

- Safety Concerns: Others worry about the efficacy and safety of compounded versions compared to brand-name medications.

The table below summarizes the key differences between Hims & Hers’ compounded offerings and Novo Nordisk’s branded drugs:

| Feature | Hims & Hers Compounded Semaglutide | Novo Nordisk Wegovy/Ozempic |

|---|---|---|

| Price (per month) | $99 | $1,349.02 (Wegovy), $935.77 (Ozempic) |

| Regulatory Status | Previously allowed under FDA shortage exemption; now banned for mass compounding | FDA-approved |

| Availability | Phased out due to regulatory changes | Widely available through telehealth partnerships |

What’s Next for Hims & Hers?

Despite the challenges, Hims & Hers is exploring new avenues for growth. The company is expanding into treatments for low testosterone, menopause, sleep disorders, and longevity. It’s also in talks with Novo Nordisk to provide branded Wegovy to patients—a move that could help stabilize its revenue streams.

The conflict between Hims & Hers and Novo Nordisk underscores the complexities of the pharmaceutical industry, where affordability, regulation, and innovation often collide. As the situation evolves, one thing is clear: the battle over weight-loss drugs is far from over.

Key Takeaways

- Hims & Hers’ compounded weight-loss drugs were priced at $99/month, far below Novo Nordisk’s branded versions.

- The FDA’s decision to lift the semaglutide shortage status has forced Hims & Hers to phase out its offerings.

- Novo Nordisk is leveraging telehealth partnerships to maintain its market dominance.

- Public opinion remains divided on the affordability vs. safety debate.

As both companies navigate this turbulent landscape, the ultimate winners—or losers—may be the patients caught in the middle.