President Trump’s Optimistic Stance on the Economy

In a recent interview with NBC News on May 2, 2025, President Donald Trump brushed aside growing concerns about a potential recession, describing the U.S. economy as being in a “transition period.” He assured the public that “everything’s OK” and expressed confidence in the country’s long-term economic performance, predicting it would do “fantastically.”

Trump’s remarks come amid escalating trade tensions with China, which have sparked fears of economic instability. Despite these concerns, the president has remained steadfast in his optimism, framing short-term economic challenges as necessary steps toward achieving broader policy goals.

Mixed Economic Indicators Fuel Uncertainty

While Trump’s assurances may offer some reassurance, recent economic data paints a more nuanced picture. Key indicators include:

- Job Growth Slowdown: April saw a marginal decline in job growth, the first in three years, partly due to preemptive import surges ahead of new tariffs.

- GDP Decline: The U.S. experienced a quarterly GDP drop, raising alarms among economists about the potential for prolonged economic sluggishness.

- Public Sentiment: A Reuters/Ipsos poll revealed a five-point drop in Trump’s approval rating since his inauguration, now standing at 42%.

Economists warn that the administration’s tariff-driven policies could lead to higher inflation and slower growth, further complicating the economic outlook.

Trump’s “Transition Period” Argument

In a pre-recorded clip from NBC’s “Meet the Press with Kristen Welker,” Trump acknowledged the possibility of a short-term recession but framed it as part of a necessary adjustment. “This is a transition period,” he said, emphasizing his administration’s focus on long-term economic revitalization.

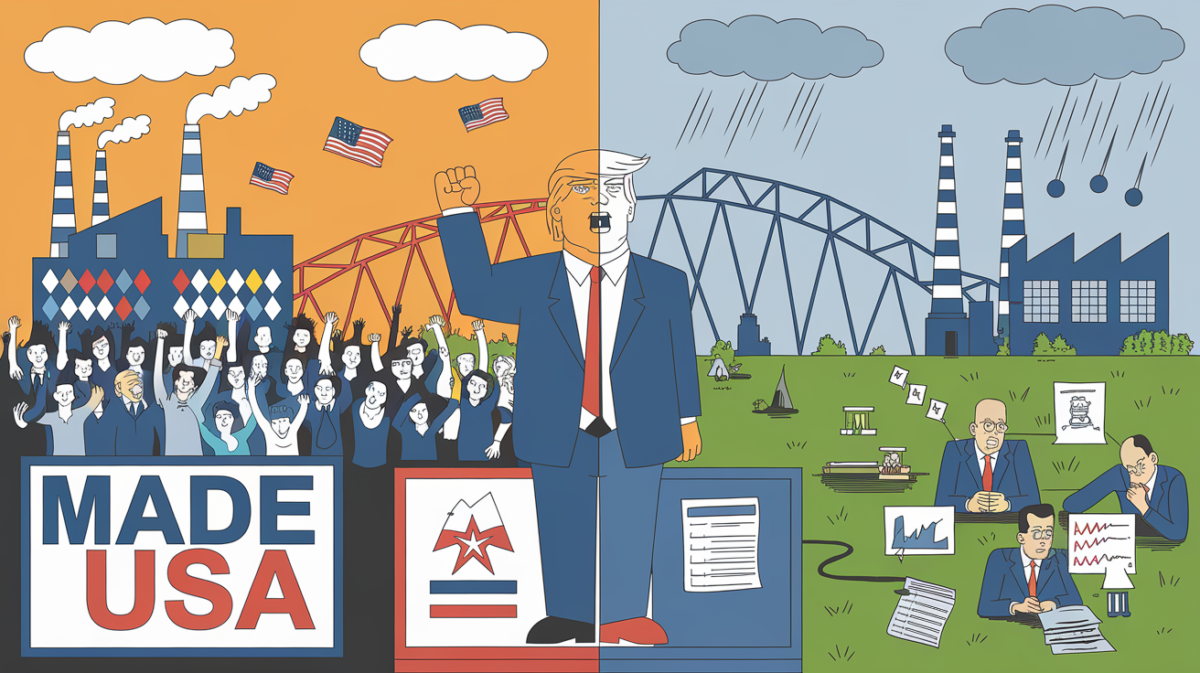

This perspective has drawn criticism from business owners and politicians who fear the immediate impacts of tariff uncertainty. However, Trump has doubled down on his trade policies, particularly those aimed at reviving domestic manufacturing.

Trade Policies and Their Economic Implications

Trump’s recent rally in Michigan highlighted his commitment to tariffs as a tool for economic reform. Key announcements included:

- A renewed push for a “fair” trade deal with China.

- A $1 trillion investment in national defense, including new jets for a Michigan military base.

While these policies aim to bolster domestic industries, economists caution that the so-called “liberation day” tariffs could have unintended consequences, such as:

| Potential Impact | Expert Analysis |

|---|---|

| Increased Inflation | Higher costs for imported goods could drive up prices for consumers. |

| Reduced Consumer Spending | Rising prices may lead to decreased purchasing power. |

| Capital Flight | Investors may seek more stable markets amid economic uncertainty. |

Balancing Optimism with Economic Realities

Trump’s unwavering confidence in the economy stands in contrast to the cautious tone of many economists. While some analysts point to resilient consumer spending and private investment as signs of potential recovery, others argue that the administration’s policies are politically motivated and economically risky.

As the trade war with China continues, the U.S. faces a delicate balancing act: pursuing long-term economic goals while mitigating short-term disruptions. Whether Trump’s optimism proves justified remains to be seen, but for now, the economic landscape is marked by both promise and uncertainty.